#10 | What Are the Risks of Investing in Index Funds? (What Beginners Should Know)

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

A Calm, Honest Guide for First-Time Investors

Primary keyword: invest in index funds

Supporting long-tail keywords (used naturally):

risks of investing in index funds

can you lose money in index funds

are index funds safe for beginners

index fund market crash

long-term index fund risk

S&P 500 risk explained

Let’s Be Honest First

If someone tells you index funds are “risk-free,” they are oversimplifying—or selling confidence, not clarity.

Index funds are not risk-free.

But their risks are very different from what beginners usually fear.

Understanding those risks is what allows you to:

Stay invested during uncertainty

Avoid emotional mistakes

Use index funds correctly

This article exists to remove vague fear—not to scare you away.

People Also Ask: Are Index Funds Risky?

Let’s address the most common Google questions upfront.

Can you lose money in index funds?

Yes, especially in the short term.

Are index funds safe for beginners?

They are among the safest ways to invest in stocks, but still involve market risk.

What happens to index funds during a market crash?

They fall with the market—and recover with it.

Are index funds risky long term?

Historically, long-term risk is lower than most alternatives.

Now let’s break down what these risks actually look like in real life.

Risk #1: Market Risk (The One Everyone Worries About)

What it is:

Index funds rise and fall with the stock market.

If the market drops 20%, your index fund drops too.

This is not a flaw.

It’s the definition of what index funds do.

Why This Risk Feels Bigger Than It Is

Beginners often imagine market drops as:

Permanent loss

A sign they did something wrong

A reason to stop investing

In reality:

Market declines are normal

Every long-term chart includes multiple drops

Recovery is part of the system

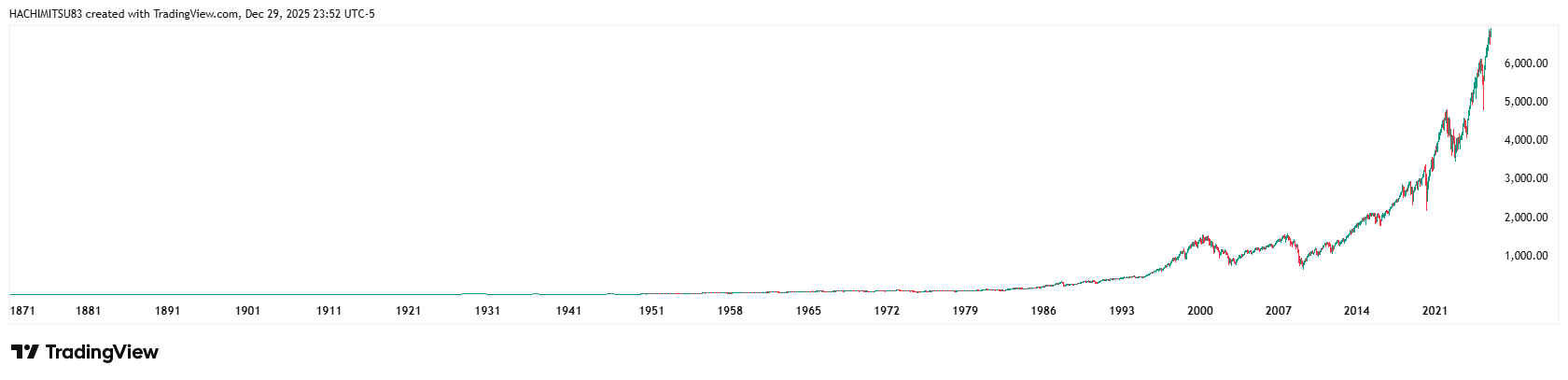

Example: S&P 500 Market Risk Explained

The S&P 500 has experienced:

Crashes

Recessions

Political crises

Global uncertainty

And yet, over decades, it has:

Recovered repeatedly

Continued upward long-term growth

Market risk exists—but time reduces it.

Risk #2: Short-Term Loss (Timing Risk)

What it is:

You invest money and see your balance go down shortly after.

This happens more often than people expect.

Why Beginners Struggle With This

First-time investors often assume:

“If I invest correctly, I shouldn’t see losses.”

That assumption causes panic.

Index funds are long-term tools. Short-term movement is noise.

How to Reduce This Risk Practically

Don’t invest money you’ll need in the next 3–5 years

Invest monthly instead of all at once

Stop checking balances daily

This aligns directly with Topic 3: How Much Should You Invest Each Month?

Risk #3: Emotional Risk (The Most Dangerous One)

This is the risk most people don’t talk about.

Emotional risk looks like:

Panic selling during downturns

Stopping contributions when markets fall

Overreacting to headlines

Ironically, this risk comes from watching too closely.

Why Index Funds Help—but Don’t Eliminate—This Risk

Index funds reduce:

Stock-picking stress

Decision fatigue

Overconfidence

But they can’t stop you from:

Selling at the wrong time

Changing strategy repeatedly

That’s why simplicity matters.

Risk #4: Inflation Risk (If You Don’t Invest)

This is often ignored, but critical.

If your money sits in cash:

Inflation slowly erodes its value

Purchasing power declines over time

Index funds, especially broad ones like the S&P 500, historically:

Outpace inflation long term

Protect real value over decades

Not investing is also a risk.

Risk #5: Overconfidence and Overcomplication

After some success, beginners sometimes:

Add too many funds

Chase performance

Abandon their original plan

This introduces unnecessary risk.

That’s why the earlier articles emphasize:

Starting with one index fund

Often the S&P 500

Keeping the system boring

Boring is safe.

Are Index Funds Safe During a Market Crash?

This question deserves a clear answer.

During a crash:

Index fund values drop

Volatility increases

Fear becomes louder

What doesn’t change:

The companies still exist

The economy continues

Recovery historically follows

Index funds don’t protect you from crashes.

They protect you from making them worse by reacting poorly.

How Long-Term Investing Reduces Index Fund Risk

Time is the most powerful risk-management tool.

Historically:

Short-term investing = unpredictable

Long-term investing = resilient

The longer you stay invested:

The less individual downturns matter

The smoother returns become

Let’s see the historical performance of S&P 500 since its lunch till today (Dec 2025). It’s wiser to focus on the long-term grwoth rather than short-term volatility.

This is why index funds are not recommended for:

Emergency savings

Short-term goals

Money you’ll need soon

The Role of the S&P 500 in Risk Management

For beginners, the S&P 500 reduces risk by:

Avoiding single-stock exposure

Spreading across industries

Reflecting the broader economy

It doesn’t remove risk—but it removes unnecessary risk.

That’s an important distinction.

Common Myths About Index Fund Risk

Myth 1: “Index funds are only safe in good economies”

False. They are built to survive bad ones.

Myth 2: “If it crashes, I lose everything”

False. Temporary decline is not total loss.

Myth 3: “I should wait until things feel stable”

Markets rarely feel stable before growth.

Final Thought: Risk Isn’t the Enemy—Confusion Is

Index funds involve risk.

So does doing nothing.

The goal isn’t to eliminate risk.

It’s to choose the kind of risk you can live with.

For first-time investors, index funds—especially starting with the S&P 500—offer:

Transparent risk

Historical context

Emotional simplicity

That’s why they work.

Unlock Your Clarity — Join Our Community Today

Any investment is contained risk, and you and minimize the risk by educate yourself and seek the current information from time to time. I’m not an expert, but here to help. Drop your questions or comments beloe and I will read all of them. Let’s expand knowledge together!